Four questions speciality chemical companies should ask now

Submitted by:

Andrew Warmington

How do you recession-proof an industry that is worldwide in scope, highly regulated, highly specialised and rife with market competition, asks Stephen Ottley, senior managing director, head of chemicals & energy of SGS Maine Pointe

Speciality chemical companies reported strong revenue growth in Q2 2022, but their path to profits currently requires passing on significant price increases in raw materials, energy and transportation. Logistics constraints and energy scarcity are exerting pressure all along the supply chain and many are lowering 2022 estimates.

Even as production volumes rebound from a slump in 2020, the speciality chemical industry faces these major challenges during a period of recession and inflation:

* Customers are responding to price increases by stockpiling and deferring orders until raw material prices drop (deflation). Recession will add to this softening and unpredictable demand variability

* Speciality chemical companies who cut capacity for 2023 will find that suppliers are becoming more selective as they look to move away from low-margin business

* To ensure competitiveness, speciality chemical companies are slowly automating and digitising but they lack the data they need to make significant changes; they often automate systems that are less than optimal

* Demand forecasting has become more difficult; for example, consumers appear ready to purchase automobiles, fragrances and cosmetics as they return to active private and work lives, but inflation and recession may curtail their enthusiasm

Yet, sustainable recession- and inflation-proofing is possible. End-to-end supply chain optimisation, synchronisation and digitisation, coupled with supplier, capacity and geographic optionality, gives a speciality chemical company the agility and resilience to survive a volatile economy and marketplace.

End-to-end supply chain optimisation

The first step in optimising a supply chain is to find out what does and does not work. That requires visibility into the end-to-end supply chain. Creating real-time visibility usually requires pulling together siloed information from multiple legacy systems. Removing these siloes and providing real-time insights is essential for business leaders who want to be responsive and make the best decisions for the business, not just their region or functional area.

With up-to-date, reliable data across the supply chain, the company can create a ‘digital twin,’ a virtual model where scenarios and trade-offs can be evaluated and business strategies tested before they are applied to the physical supply chain. Given the model’s recommendations, the company can go on to identify bottlenecks and reduce risks.

Synchronisation & digitisation

Synchronising the supply chain with the core interests of the company ensures that procurement, operational, logistical and financial decisions are made with a full understanding of their sustainability and risks.

For example, the decision of where to build a new plant has more than financial ramifications. It has an impact on and is impacted by access to suppliers and raw material markets, transportation and logistical issues, political and weather upheavals, customer satisfaction and perception, and IP security, among other considerations.

Synchronisation also involves aligning processes, people and physical assets so that they all contribute to value creation in line with the company’s core business drivers. Any attempt to simplify, standardise and digitise the supply chain will falter without that alignment.

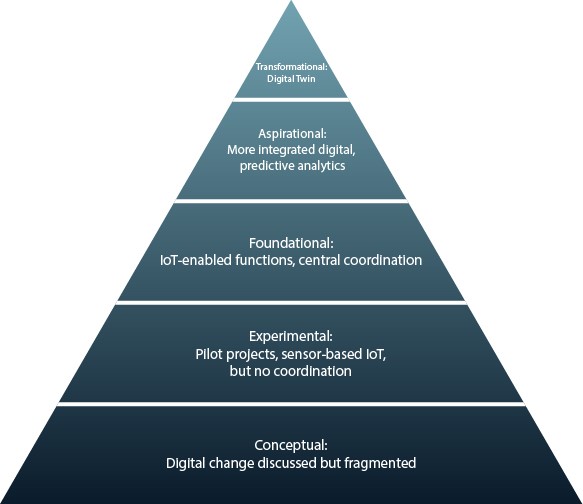

The Gulf Petrochemicals & Chemicals Association reports that 64% of chemical companies have undertaken digitisation initiatives but less than 44% have moved beyond the pilot stage, an indication of digital immaturity as illustrated abov.1 The biggest problems in creating a digitally enabled supply chain is not choosing the technology but instead making sure that:

* Meaningful data is collected and shared across the enterprise: Many speciality chemical companies lack company-wide KPIs and metrics for efficient, consistent data collection; for others, the necessary data is available but closely held in siloes; and for others, the data is accessible, but the company lacks an operating model to use it effectively

* Digitisation is based on systems that are efficient and easy to control: When automation is simply tacked onto legacy systems, the problems with those systems do not magically disappear. Automated bottlenecks are still bottlenecks and should be rectified before digitisation through end-to-end optimisation of the supply chain

With the right data at the right time, it is possible to construct a digital twin of the supply chain, a simulation that allows the C-suite to test decisions against real-world data. In the example given earlier, the company can test the effects of proposed locations against the risks and decide whether the build decision itself is optimum: should it improve its use of current facilities, expand existing facilities or acquire more facilities rather than building new?

Possible results

Now is the time for speciality chemicals companies to negotiate strategic 2023-2024 agreements to ensure supply. The goal of any negotiation with suppliers is to clarify the company’s needs, select the suppliers who best meet those needs, standardise supplier relationships, and increase supplier optionality (off-shoring, near-shoring, low-cost-country, non-China sourcing, or some combination) to prepare for recession and inflation.

For example, a manufacturer of performance polymers. faced a volatile and inflationary supply chain and a procurement department in turmoil. SGS Maine-Pointe made gaps in the supply chain visible, coached the company’s new VP of procurement and the procurement team in global supplier optionality and strategic win-win negotiation, and forged closer relationships with domestic suppliers. The results included a 6% reduction in costs, 50% value creation and a procurement team that was primed to deal with inflation and recession.2

This is also the time to enhance data access, data analytics, consistency, and accountability throughout the plan-buy-make-fulfill supply chain. An efficient supply chain occurs only once everyone in a company is fully aligned with core business drivers and digitisation builds upon a firm foundation.

SGS Maine Pointe similarly helped a manufacturer of engineered speciality chemicals to overcome issues with integrating a major acquisition, reducing ‘legacy inventory’ of over 2,500 tonnes and utilising technology in an increasingly commoditised business. Among other results, the company received a new inventory model and policies that shaped demand toward their preferred product, reduced phantom demand and ultimately cut the legacy inventory by 75%.3

Preparing for inflation, recession, or whatever shift the economy chooses to take becomes easier when the C-suite has insight into and control over the end-to-end supply chain. With the techniques of optimisation, synchronisation, digitisation and optionality, a speciality chemical company strengthens its ability to negotiate with suppliers, meet growth and profit goals, and receive a healthy ROI.

Contact:

Stephen Ottley

Senior Managing Director, Head of Chemicals & Energy

SGS Maine Pointe

References:

2. https://www.mainepointe.com/success-stories/increasing-supply-chain-value-amid-turmoil-cs263