Activist’ shareholder cranks up pressure on Elementis

Submitted by:

Andrew Warmington

Gatemore Capital Management has published a second open letter to John O’Higgins, chairman of the board at UK-based speciality chemicals company Elementis. This follows its first such letter on 29 April and the company’s official response.

Gatemore, which holds 4.5 million shares (about 0.6%) in Elementis via its Gatemore Special Opportunities Fund, said that it viewed the response as “wholly inadequate as it merely reiterated the company's existing, ineffective strategy without addressing any of our concerns. We also note it was released only a few hours after our letter was published, implying not only hastiness, but also a fundamental unwillingness to engage with the critical issues at hand.”

The new letter, signed by managing partner Liad Meidar, reiterated its “firm belief” that accelerating the cost-savings programme, replacing CEO Paul Waterman and conducting a strategic review, including a potential disposal of the Talc business, “are essential to improving the company's performance and unlocking shareholder value”. Gartmore also repeated its concern about a “misalignment of interests” between the board and shareholders.

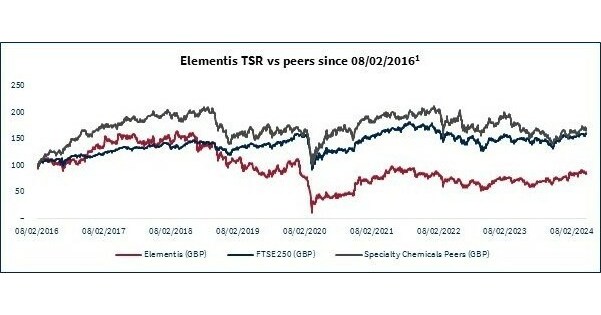

On 30 May, Gartmore said, it learned that Waterman had sold 350,000 shares, about 18% of his stake, taking it to 0.3%. This act “at such a critical time for Elementis is tone-deaf in the context of extensive cost cuts” and “sends an extremely poor signal to shareholders on the CEO's views on the future prospects of the business”. In his 18 years at the helm, Waterman had earned £14 million, despite the share price underperforming its sector by 76%.

“We have engaged with many of the largest active shareholders of Elementis and believe there is unity on all these issues. We strongly urge you and the board to take prompt and decisive action,” Gartmore said. “Failing this, we may be compelled to unite the shareholders and pursue the replacement of the chairman through an extraordinary general meeting to drive the necessary change within Elementis.”

Elementis mainly supplies the personal care sector, notably cosmetic and antiperspirant actives – it is the world market leader in the latter field. 85% of its products are of natural origin. Coatings and paper are other key markets.

In November 2023, another activist, Franklin Mutual Advisers, had published a similar open letter to O’Higgins, calling for Elementis to be put up for sale. It accused the company of “a shocking amount of shareholder value destruction”, mainly from buying SummitReheis and Mondo Minerals.

Gartmore’s original letter highlighted the gulf between the firm’s “fundamental strength” and its “persistently weak share price. Elementis, it said, “is an attractive business that has lost its direction” and should be doing better, based on various factors:

* The importance of rheology modifiers, an area of company expertise, in product formulation

* Customer loyalty, especially in coatings

* Owning a hectorite mine in California

* Consistently strong historical gross profit margins

Blaming Waterman for the poor share performance since 2016, it cited: poor capital allocation with a $650 million net spend on M&A, over a half of its current entire market capitalisation, notably overspending on Mondo Minerals; repeated operational underperformance; and rejecting three takeover approaches from Minerals Technologies and Innospec in 2020-1.

Elementis did not directly respond. Instead, it said: ‘The board continues to believe that shareholder value is best driven by a focus on delivering the substantial actions that are currently being progressed at pace throughout the business and that underpin progress towards the 2026 targets of 19%+ operating margin, over 90% cash conversion and over 20% return on capital, generated by $90 million of above market revenue growth and $30 million cost savings.”