Digital horizons

Submitted by:

Andrew Warmington

Mica Zuniga and Fiona O’Carroll of Xenon Arc look at how the chemicals and materials industries can tap into enhanced digital strategies to improve their customer experience

Companies throughout the chemicals and materials industries have embraced the promises of Industry 4.0, modernising manufacturing and production facilities, automating where possible, and making huge strides in sustainability and environmental responsibility. Yet for all this progress, other B2B industries zoomed forward, aligning their operations and business models to an emerging opportunity - the digitisation of the customer experience.

This is not a new idea, of course. A 2018 report from IDC showed that two-thirds of Global 2000 CEOs planned to shift their focus to digital strategies to enhance the customer experience. COVID-19 acted as an accelerant. “We’ve seen two years’ worth of digital transformation in two months,” said Microsoft’s CEO Satya Nadella in a recent earnings call.

Barriers to innovation

In a recent McKinsey survey of 1,000 B2B decision makers, lack of speed in interactions with suppliers emerged as the top ‘pain point’, mentioned twice as often as price. Digital solutions loom large in executives’ thinking as a way to make routine tasks more efficient. Some 86% of respondents said they prefer using self-service tools for reordering, rather than talking to a sales representative.

However, the chemical and materials industry faces a significant challenge in the quest for an enhanced customer experience. Legacy business silos, routes to market, technology, service and operational paradigms are often at odds with today’s customer expectations and requirements.

According to Paul Do Forno, managing director of the Commerce & Content practice at Deloitte, over half of all B2B businesses are not focused on growing revenue through digital channels, even though 56% of B2B buyers will pay more for a better online experience. This article lists some proven strategies to leapfrog the learning curve and improve the customer experience, catalysing success for years to come.

Customer centricity

B2B companies seeking to embrace digital transformation must fundamentally change how they see the world. Instead of serving the needs of shareholders or corporate leadership, companies must place customer needs at the centre of everything they do and strike the right balance between digital and human interaction. Furthermore, leadership must orchestrate a cross-functional view that places customer needs ahead of internal operational and business silos and channel conflict.

Daniel Futter, CCO of Dow Chemical, recently published a series of articles on eCommerce in the chemical industry. “To me it becomes clear that in order to have a successful eCommerce platform, customer needs must live at the centre of every single aspect of the user experience,” he said.

“By association, if any of those small steps break down, the overall opportunity to create a loyalty building experience is lost, or at least jeopardised … Keep the buying experience quick and intuitive; make product available at competitive and transparent prices; and don’t bundle with unnecessary service ‘embellishments” that customers don’t value.”

To drive success, B2B companies should focus on designing hybrid solutions that combine digital and human interactions into one seamless customer experience. Indeed, the best eCommerce and digital systems help customers navigate the entire customer journey, from the initial discovery of a brand to the post-purchase support.

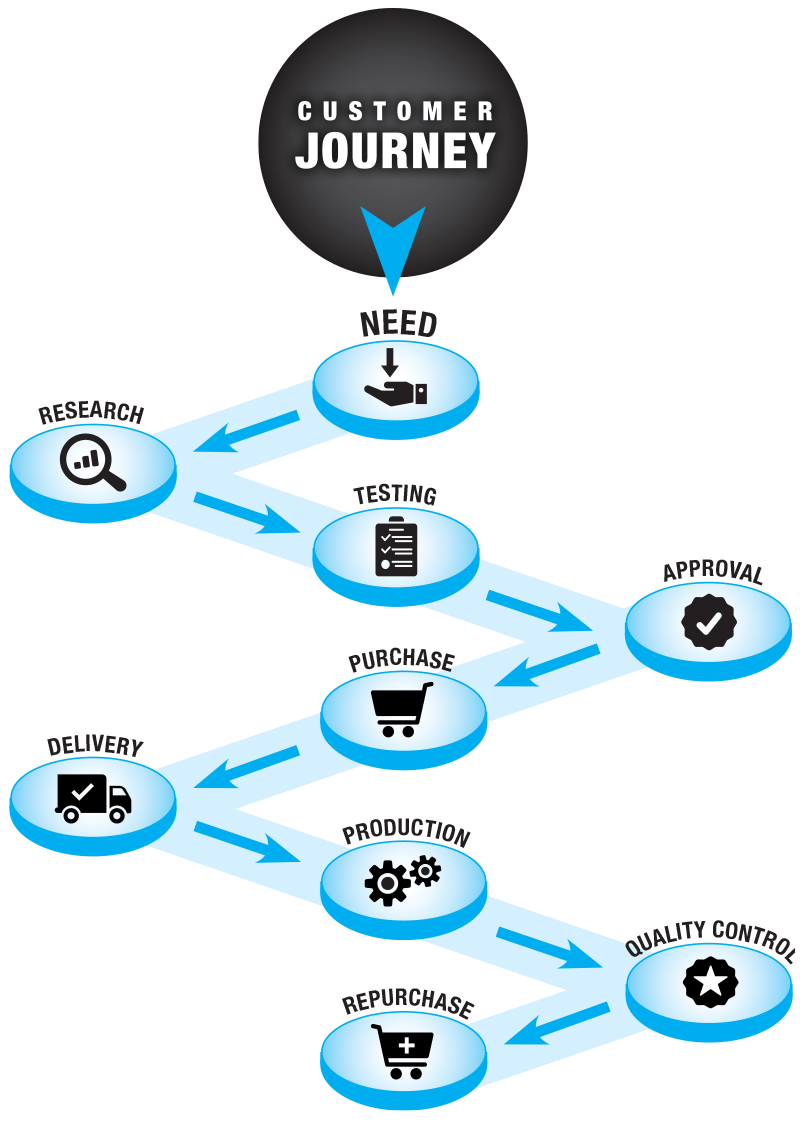

The customer journey

To create powerful, customer centric business strategies, chemicals and materials companies must understand every step of the customer journey, as pictured above. In its 2020 Voice of the Customer (VoC) research study ‘SMB Frontiers’, Xenon Arc asked customers to outline their journeys, with the goal of determining how the customer experience can be digitised and where investments should be prioritised. Here are the top steps that leading companies take as part of their customer journey:

1. Need: Customers develop a need via four key processes: new product development, customer specification, product delay or discontinuation, and supplier recommendation.

2. Research: Once they have identified a need, they start researching potential options, using a variety of different tools, contacts, and analyses before making a selection

3. Testing: Most chemical and materials customers are required to validate their selection by going through a testing and qualification process. This can vary from a relatively short review of a data sheet to an extensive multi-year test

4. Approval: Once the material is confirmed to work in the application, the customer generally must go through an approval process. In the food industry, this can involve label approval, vendor approval, pricing and technical documentation approval

5. Purchase: Once approved for purchase, the customer engages in a purchase process, which may occur online, over the phone, via email, EDI or fax

6. Delivery: Arguably the most critical aspect of any customer journey is the ability to achieve on-time, in-full (OTIF) delivery repeatedly, as well as real-time accuracy of freight quotes, tracking, order status and delivery dates

7. Production: Once the customer has received the product and is using it in production, they look for best practices, maintenance and operational information and usage tools from suppliers

8. Quality control: Customers are continually monitoring the ongoing performance of their production and the quality of their end products, often requiring documentation, technical support and advice to optimise outcomes

9. Repurchase: The goal of the entire customer journey is to earn repeat purchases and secure customers’ long-term loyalty

Customer segmentation

Now that you have a clear sightline ahead, you have to understand what your customers want and who is your top priority. That means customer segmentation, but you should not bite off more than you can chew.

Often, companies that are setting out on the quest for customer-centricity start with their strategic, multi-million-dollar, integrated customers. However, these large enterprises are usually less receptive to their efforts and require suppliers to work within their portals, shackling the ability to make any significant changes to digital infrastructure and tools.

For most, a better starting point comes with small to medium-sized customers. These companies typically purchase standardised products and have fragmented customer bases, offering unique avenues for digitisation, and hence, enhanced customer centricity.

To better segment your customers, try using a VoC study or a customer survey, or tap any enterprise data resources that reflect customer needs. From there, identify key objectives, whether attracting new customers, simplifying order entry processes or enhancing loyalty.

“We used a VoC study to drive our decision-making and remove the guesswork,” said the CMO of a mid-size speciality chemicals distributor. “We identified a range of unmet needs, and then we were able to start thinking about the right digital solutions to meet them. But what we never saw coming was that this feedback gave our entire C-suite, especially the financial team, the confidence to fund these investments, which sped the process significantly.”

Plethora of options

Further complicating the process is the plethora of providers and innovator. They often creating disjointed systems, which often address different parts of the journey, making a seamless and holistic solution even more difficult to achieve. As senior executives weigh their options, it is important to evaluate how each option meets the customers’ needs and, at the same time, safeguards the company’s brand integrity, data ownership and relationship with the customer:

* R&D/research tools: From service providers and software companies to producers, there are many emerging tools for researchers to leverage as they develop new products. In the COVID and post-COVID world, online research tools are going to become an imperative as part of a revised discovery process

* Marketplace: There are several emerging marketplaces and some well-established players, in the industry, including broad-based platforms, such as Amazon and Alibaba, and more focused offerings from within the industry

* Distributors: Many traditional distributors, from broad-line to small and regional, have offered customer portals for years and are continuing to invest in this space. These often offer extensive catalogues but with limited brand or product differentiation

* Platforms/DIY: Many producers have elected to develop their own eCommerce sites using platforms such as Magento, B2BCommerce and Shopify. The benefit to this approach is that the producer retains control over their sales process, brand and data

* End-to-end providers: Only a few platforms have created full end-to-end systems, including research tools, dynamic pricing, live technical support, order history and other functionality designed specifically for the chemicals and materials industry

Many paths up the mountain

As you seek to elevate the customer experience, remember that there is no single path up the mountain of success. Selecting the right digital strategies means asking hard questions.

Will you be able to meet the customer requirements for transparency on price, availability and lead time? Can you provide real-time integration with your ERP system? Will the site be supported via chat functionality and real-time information on order status? And what is your real OTIF performance?

As the chemicals and materials industries embrace digital innovation, companies who navigate the process with discipline, focus and good partners, will emerge with a model that delights customers—and drives innovation for years to come.

Contact:

Mica Zuniga

Senior Vice President, Strategic Growth

Xenon arc

+ 1 425 518 0382

www.xenonarc.com