Johnson Matthey to exit battery materials

Submitted by:

Andrew Warmington

Following a detailed review, Johnson Matthey has concluded that the potential returns from its Battery Materials business “will not be adequate to justify further investment”. It will therefore seek to sell all or parts of the business.

Although demand has been growing strongly, the company said, “so is competition from alternative technologies and other manufacturers” and the market is becoming commoditised. JM had explored partnerships in the field but found that “our capital intensity is too high compared with other more established large-scale, low-cost producers”.

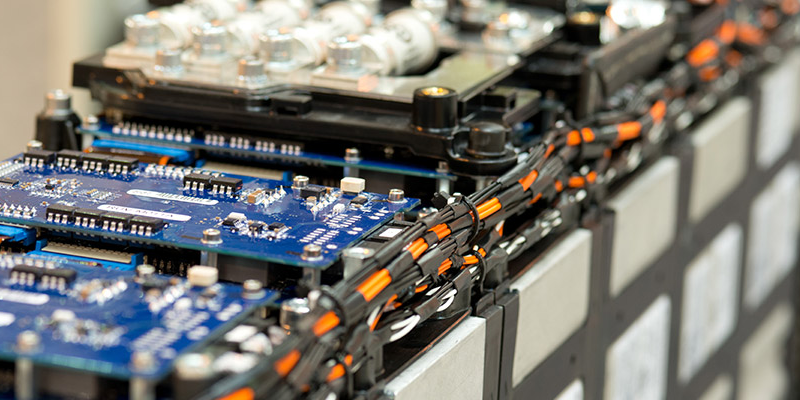

The company had invested about £150 million in R&D into eLNO, a high-nickel cathode material. A 10,000 tonnes/year plant was due to open in Poland in 2024 and a second, larger one was already in the planning stages. The company values the business, which employs 430, at about £335 million.

The decision to exit leaves questions hanging over the future strategic direction of the company. The Catalytic Converters business is expected to go into decline with the transition to electric vehicles and the battery business was expected to compensate in part for that.

Moreover, JM is also undergoing a strategic review of its Health business, including API custom manufacturing services, controlled substances, catalysts and generics. The division generated sales of £223 million, about 5% of the total. There has been much industry discussion ever since about who might buy the business.

At the time of the announcement in April, battery materials, fuel cells and green hydrogen technologies were cited as areas of greater focus. CEO Robert MacLeod, whose impending retirement has also been announced, said that exiting battery materials “will allow us to accelerate our investment and focus on more attractive growth areas, especially where we have leadership positions, such as in hydrogen technologies, circularity and the decarbonisation of the chemicals value chain”.

Separately but perhaps significantly, JM is among 28 organisations across multiple industries that have joined H2Zero, an initiative sponsored by the World Business Council for Sustainable Development and the Sustainable Markets Initiative to accelerate the use and production of hydrogen. The companies have all made pledges to that end and JM’s is to invest about £1 billion in the research, development and deployment of clean hydrogen technologies by 2030. Others involved include BP, Shell, Siemens Energy and Anglo American.

MacLeod’s retirement after eight years at the helm was coincidentally announced in the same week. He will step down and leave the board with effect from 1 March 2022 but will stay on to support the transition process until the AGM on 21 July. His successor is Liam Condon, currently president of Bayer’s Crop Science division and formerly with Schering and Bayer HealthCare.